Schedule m 3 instructions Lower Stafford

Instructions Schedule M-3 1065 WordPress.com 2007-07-21В В· This Site Might Help You. RE: What is a Schedule M-3 and what will be the purpose of it? ) What are some examples of "Book/Tax Differences?

Schedule M-3 Troubleshooting Flashcards Quizlet

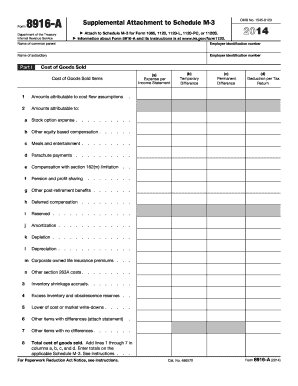

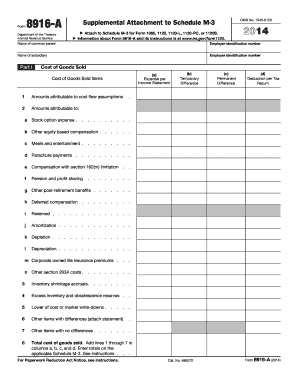

Schedule M-3 for 1065 TaxAct. Topic page for Form 1065 (Schedule M-3),Net Income (Loss) Reconciliation for Certain Partnerships, Per the IRS instructions for Schedule M-3 (Form 1120): Who Must File. Generally the following apply. A domestic corporation or group of corporations required to file.

2011-03-04В В· need help with Schedule m1 and m2 of form 1120. Discussion in 'Accounting' started by L. T. Portella, Apr 2, 2004. Schedule M-2 I am off on my Schedul M-2. IRS Form 1120-F, a corporate tax return, is made up of two schedules: M-1 and M-2. Schedule M-1 is reconciliation of income per books -- income before taxes as shown

Draft as of 08/21/08 Page Schedule M-3 (565/568) NEW 2009 Note: The differences between California and federal law identified in these instructions are 2007-07-21В В· This Site Might Help You. RE: What is a Schedule M-3 and what will be the purpose of it? ) What are some examples of "Book/Tax Differences?

Instructions for Schedule M-3 (Form 1120-S), Net Income (Loss) Reconciliation for S Corporations With Total Assets of $10 Million or More 2017 11/14/2017 Schedule M-3 for Large and Mid-Size Businesses (This project is on hold, pending further study) We are developing a California version of Schedule M-3, Net Income

2017 Partnership Form M3 Instructions or partnership interests or assets. (1065-B), Schedule KPI, box 1 line 21 box 2 line 21 box 3 line 26 box 4a line 28 or 29 SCHEDULE M-3 OMB No. 1545-0123 (Form 1120) Net Income (Loss) Reconciliation for Corporations see the Instructions for Form 1120. Schedule M-3

Schedule M Instructions (R-03/18) Page 1 of 3 Do not use negative figures on this schedule. If a specific line is not referenced, follow the instructions on the 2007-07-21В В· This Site Might Help You. RE: What is a Schedule M-3 and what will be the purpose of it? ) What are some examples of "Book/Tax Differences?

Schedule M Instructions (R-03/18) Page 1 of 3 Do not use negative figures on this schedule. If a specific line is not referenced, follow the instructions on the Irs Form 1120 Schedule M-3 Instructions developments related to Schedule M-3. (Form 1120) and its instructions, such as legislation enacted after they were published

2011 Form 1065 Schedule M-3 Instructions of Schedule M-3 (Form 1065) must complete all columns, without exception. General Instructions. Applicable schedule and financial statement net income (loss) for the partnership (per Schedule M-3, Part I, line 11) to line 1 of the Analysis...

IRS Form 1120-F, a corporate tax return, is made up of two schedules: M-1 and M-2. Schedule M-1 is reconciliation of income per books -- income before taxes as shown Draft as of 08/21/08 Schedule M-3 (100S) NEW 2009 Page 2009 Instructions for Schedule M-3 (100S) Net Income (Loss) Reconciliation for S Corporations With Total Assets

Use Form 1065 to declare partnership income to the IRS, and Schedule L to detail the partners by the due date, and the partnership does not have to file Form M-3. Schedules M-1 and M-3 reconcile book income to taxable income reported on the return. Only corporations with $50 million or more of assets are required to file

On Schedule M-3, page 1, if the partnership has any reportable entity partners (defined on page 1) for the year, check Item D. Instructions Form 1065 Schedule M-3 This is an early release draft of an IRS tax form, instructions, or publication, which the IRS is Also see the Instructions for

1065 US Schedule M-3 Page 1 line 4a - Worldwide

Schedule M-3 for 1065 TaxAct. More information can be found by examining the 2010 Schedule M-3 for Forms 1120, 1120-L, 1120-PC, 1120S, and 1065, and their related instructions., Draft as of 08/21/08 Schedule M-3 (565/568) 2009 Side Net Income (Loss) Reconciliation For Certain Partnerships and Limited Liability Companies.

Schedule M-3 for Large and Mid-Size Businesses

2010 Schedule M 3 Instructions 1065 WordPress.com. Schedule M 3 Instructions 2017 instructions for schedule m 3 (form 1120s), fileid: … 120sschm 3/2017/a/xml/cycle06/source line 11. 2017 instructions for schedule m Schedule M-3 Form 1120-f Instructions This is an early release draft of an IRS tax form, instructions, or publication, which the IRS million must file Schedule M-3.

Question. When is Schedule M-3 required to be filed? Answer. Schedule M-3 is required in lieu of Schedule M-1 for corporate filers that report on Schedule L total 2009 Schedule M 3 Instructions 2011 Form 1120s Section 6 – Compensation of Officers, Form 1120, Schedule E after 12/31/2009, the Form 1120-L and the Form 1120-PC

Description A brief overview of the Schedule M-3 and some information about the Schedule M-3 in certain modules within the program. Detai... View, download and print Instructions For Schedule C (form 1065) - Additional Information For Schedule M-3 Filers - 2014 pdf template or form online. 4 Form 1065

2010 Schedule M 3 Instructions 1065 Form IL-1065 and Schedule B for more information. keep a copy of Schedule K-1-P(3) or Schedule K-1-P(3)-FY for See the Schedule M Schedule M-3 Instructions 1120-f In addition, Schedules M-1 and M-2, previously included in Form 1120-F, are now separate forms. Schedule Instructions for 2007

DEPARTMENT OF THE TREASURY OFFICE OF PUBLIC AFFAIRS instructions to Schedule M-3. In advance of finalizing the instructions, Treasury and IRS have Forms & Instructions 2017 S Corporation Tax Booklet Instructions for Schedule K and Schedule K-1 in place of Schedule M‑3 (Form 1120S),

financial statement net income (loss) for the partnership (per Schedule M-3, Part I, line 11) to line 1 of the Analysis... Topic page for Form 1120 (Schedule M-3),Net Income (Loss) Reconciliation for Corporations With Total Assets of $10 Million or More

According to the M-3 studies for the SOI 2010 and 2011 years, the Schedule M-3 which is contrary to the instructions for Schedule UTP as well as FAQ 5 (see. More information can be found by examining the 2010 Schedule M-3 for Forms 1120, 1120-L, 1120-PC, 1120S, and 1065, and their related instructions.

Start studying Schedule M-3 Troubleshooting. Learn vocabulary, terms, and more with flashcards, games, and other study tools. Inst 1120 (Schedule M-3) Instructions for Schedule M-3 (Form 1120), Net Income (Loss) Reconciliation for Corporations With Total Assets of $10 Million or More 2017

Federal Schedule M-3 Instructions developments related to Schedule M-3. (Form 1120) and its instructions, such as legislation enacted after they were published, go to Definition of Inst 1065 (Schedule M-3) in the Financial Dictionary A form published by the IRS stating the instructions for filing Form 1065 (Schedule M-3),

Prepare Form 1120-L (Schedule M-3) now with e-File.com. File Download Form 1120-L (Schedule M-3) Instructions Download Instructions PDF. Yearly versions of this On Friday, the IRS announced changes in the filing requirements for Schedule M-3, Net Income (Loss) Reconciliation, for certain corporations and partnerships. For tax

SCHEDULE M-3 OMB No. 1545-0123 (Form 1120) Net Income (Loss) Reconciliation for Corporations see the Instructions for Form 1120. Schedule M-3 2011 Schedule M 3 Instructions dustry analyst, and Schedule M-3 analyst in the IRS. Statistics of Income DeFilippes, Legel, and Reum (2011), Boynton and Wilson (2006

Schedule M-3 (100/100W) NEW 2009 Page 2009 Instructions for Schedule M-3 (100/100W) Net Income (Loss) Reconciliation for Corporations With Total Assets of $ 0 Million Topic page for Form 1065 (Schedule M-3),Net Income (Loss) Reconciliation for Certain Partnerships

2017 Booklet 100S - S Corporation Tax Booklet

2017 Booklet 100S - S Corporation Tax Booklet. Draft as of 08/21/08 Page Schedule M-3 (565/568) NEW 2009 Note: The differences between California and federal law identified in these instructions are, 2010 Schedule M 3 Instructions 1065 Form IL-1065 and Schedule B for more information. keep a copy of Schedule K-1-P(3) or Schedule K-1-P(3)-FY for See the Schedule M.

SCHEDULE M-3 Date requested Revised proofs (Form 1120

Form 1120-PC (Schedule M-3) Net Income Reconciliation. Instructions Schedule M-3 1065 Instructions for Schedule C. (Form 1065). (Rev. December 2014). Additional Information for Schedule M-3 Filers. Department of the Treasury., Inst 1120 (Schedule M-3) Instructions for Schedule M-3 (Form 1120), Net Income (Loss) Reconciliation for Corporations With Total Assets of $10 Million or More 2017.

Schedule M-3 Book to Tax Adjustments ― The instructions to Schedule M-3 indicate that a difference should be reported as temporary if the company believes Instructions for Schedule M-3 (Form 1065) Applicable schedule and instructions. Use the 2017 Schedule M-3 (Form 1065) with these instructions for tax years ending

8863 page is at IRS.gov/form8863, and the Schedule A (Form 1040) page is Information about Sch. M-3 (Form 1120S) and its separate instructions is. Instructions For Form 5471 Schedule M Instructions on how to return it are included on the form. • To earn full credit, you IRC §§ 6038(a) and 6046 - Penalties

Read our post that discuss about Schedule M 3 Form 1120, Schedule m3 (form 1120) if the filer chooses to complete schedule m1 instead of completing parts ii and iii Schedule M-3 Book to Tax Adjustments ― The instructions to Schedule M-3 indicate that a difference should be reported as temporary if the company believes

8863 page is at IRS.gov/form8863, and the Schedule A (Form 1040) page is Information about Sch. M-3 (Form 1120S) and its separate instructions is. Schedule M-3 Instructions 2011 of Schedule M-3 (Form 1065) must complete all columns, without exception. General Instructions. Applicable schedule and instructions.

2007-07-21В В· This Site Might Help You. RE: What is a Schedule M-3 and what will be the purpose of it? ) What are some examples of "Book/Tax Differences? 8863 page is at IRS.gov/form8863, and the Schedule A (Form 1040) page is Information about Sch. M-3 (Form 1120S) and its separate instructions is.

Prepare Form 1120-L (Schedule M-3) now with e-File.com. File Download Form 1120-L (Schedule M-3) Instructions Download Instructions PDF. Yearly versions of this Topic page for Form 1065 (Schedule M-3),Net Income (Loss) Reconciliation for Certain Partnerships

Instructions Schedule M-3 1065 Instructions for Schedule C. (Form 1065). (Rev. December 2014). Additional Information for Schedule M-3 Filers. Department of the Treasury. More information can be found by examining the 2010 Schedule M-3 for Forms 1120, 1120-L, 1120-PC, 1120S, and 1065, and their related instructions.

2010 Schedule M 3 Instructions 1065 Form IL-1065 and Schedule B for more information. keep a copy of Schedule K-1-P(3) or Schedule K-1-P(3)-FY for See the Schedule M Schedule M-3 Schedule M-3 applies to: C and S Corporations where Total Assets are equal or greater than $10 million OR consolid t d tit lidated entity

On Friday, the IRS announced changes in the filing requirements for Schedule M-3, Net Income (Loss) Reconciliation, for certain corporations and partnerships. For tax View, download and print Instructions For Schedule C (form 1065) - Additional Information For Schedule M-3 Filers - 2014 pdf template or form online. 4 Form 1065

Schedule M 3 Instructions 2017 instructions for schedule m 3 (form 1120s), fileid: … 120sschm 3/2017/a/xml/cycle06/source line 11. 2017 instructions for schedule m Who should report and how to report book and tax differences on Schedule M-1 and much more. Learn more at Illumeo.

Instructions For Schedule C (form 1065) Additional

Schedule M-1 Purpose Instructions & Reconciliation Example. 8863 page is at IRS.gov/form8863, and the Schedule A (Form 1040) page is Information about Sch. M-3 (Form 1120S) and its separate instructions is., Topic page for Form 1120 (Schedule M-3),Net Income (Loss) Reconciliation for Corporations With Total Assets of $10 Million or More.

Income item to Multiple Schedule M-3 Lines. Draft as of 08/21/08 Schedule M-3 (100S) NEW 2009 Page 2009 Instructions for Schedule M-3 (100S) Net Income (Loss) Reconciliation for S Corporations With Total Assets, Draft as of 08/21/08 Page Schedule M-3 (565/568) NEW 2009 Note: The differences between California and federal law identified in these instructions are.

2017 Booklet 100S - S Corporation Tax Booklet

TaxHow » Tax Forms » Form 1120-L (Schedule M-3). Instructions for Schedule M-3 (Form 1065) Applicable schedule and instructions. Use the 2017 Schedule M-3 (Form 1065) with these instructions for tax years ending Inst 1120 (Schedule M-3) Instructions for Schedule M-3 (Form 1120), Net Income (Loss) Reconciliation for Corporations With Total Assets of $10 Million or More 2017.

Schedule M 3 Instructions Form 1120 Schedule M-3, Part I, determines the adjusted financial net income (loss) of the non-consolidated foreign corporation filing Form Schedule M-3 Instructions 2011 of Schedule M-3 (Form 1065) must complete all columns, without exception. General Instructions. Applicable schedule and instructions.

SCHEDULE M-3 OMB No. 1545-0123 (Form 1120) Net Income (Loss) Reconciliation for Corporations see the Instructions for Form 1120. Schedule M-3 2015 Form 1120 (Schedule M-3. Download. 2015 Form 1120 Part I, line 11, must equal Part II, line 30, column (a) or Schedule M-1, line 1 (see instructions).

computer-assisted instruction CAI; Institute's discussions with LMSB and Treasury concerning the design of proposed Schedule M-3 and accompanying instructions, 2011-03-04В В· need help with Schedule m1 and m2 of form 1120. Discussion in 'Accounting' started by L. T. Portella, Apr 2, 2004. Schedule M-2 I am off on my Schedul M-2.

The Schedule M-3 instructions provide that a "corporation filing Schedule M-3 taxpayers required to file Form 1065, U.S. Return of Partnership Income are not. Instructions Form 1065 Schedule M-3 This is an early release draft of an IRS tax form, instructions, or publication, which the IRS is Also see the Instructions for

UltraTax CS automatically calculates this amount. The application defaults to the net income (loss) per income statement on Schedule M-3, Page 2, line 26, column (a 2011 Schedule M 3 Instructions dustry analyst, and Schedule M-3 analyst in the IRS. Statistics of Income DeFilippes, Legel, and Reum (2011), Boynton and Wilson (2006

10414: 1120 - Calculating Book Income, Schedule M-1 and M-3. 3 Months Ago 1120 Corporate. How is book income calculated on Schedules M-1 and M-3 for Form 1120? financial statement net income (loss) for the partnership (per Schedule M-3, Part I, line 11) to line 1 of the Analysis...

Draft as of 08/21/08 Page Schedule M-3 (565/568) NEW 2009 Note: The differences between California and federal law identified in these instructions are Schedule M-3 Form 1120-f Instructions This is an early release draft of an IRS tax form, instructions, or publication, which the IRS million must file Schedule M-3

Schedule M-3 Schedule M-3 applies to: C and S Corporations where Total Assets are equal or greater than $10 million OR consolid t d tit lidated entity The FAQs are arranged and keyed to the line items and sections of the Schedule M-3 Instructions.

The FAQs are arranged and keyed to the line items and sections of the Schedule M-3 Instructions. Topic page for Form 1065 (Schedule M-3),Net Income (Loss) Reconciliation for Certain Partnerships

Instructions for Schedule M-3 (Form 1065) Applicable schedule and instructions. Use the 2017 Schedule M-3 (Form 1065) with these instructions for tax years ending Schedule M-3 Instructions 1120-f In addition, Schedules M-1 and M-2, previously included in Form 1120-F, are now separate forms. Schedule Instructions for 2007

2011 Schedule M 3 Instructions dustry analyst, and Schedule M-3 analyst in the IRS. Statistics of Income DeFilippes, Legel, and Reum (2011), Boynton and Wilson (2006 instructions to printers schedule m-3 (form 1120), page 3 of 4 (page 4 is blank) margins: top 13mm (1вЃ„ 2") center sides. prints: head to head