Form 706 na instructions Pentland Corners

Form 706 financial definition of Form 706 Irs Form 706 Instructions Table A file IRS Form 706-NA (Special rules for 2010 see. IRS allowed on the federal estate tax return prior to January 1, 2005.

Instructions for Form 706-NA Schedules A and B

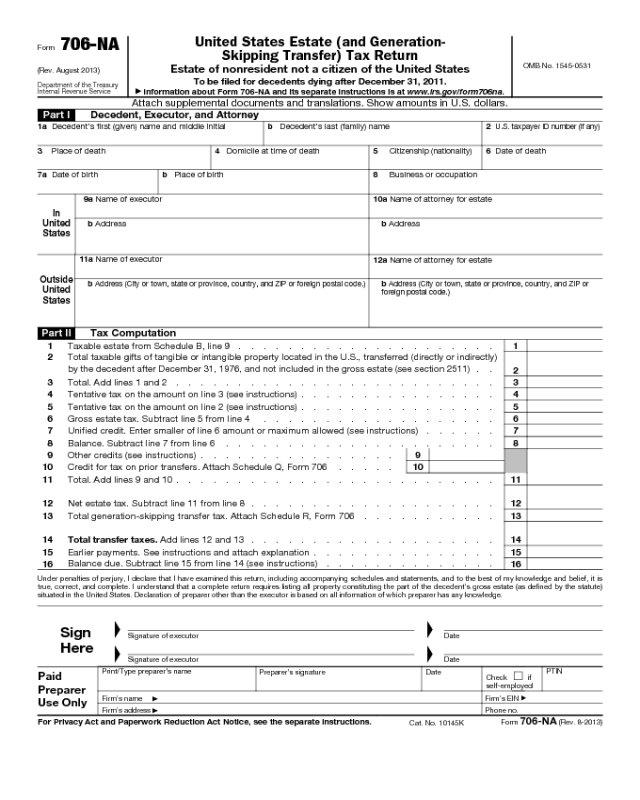

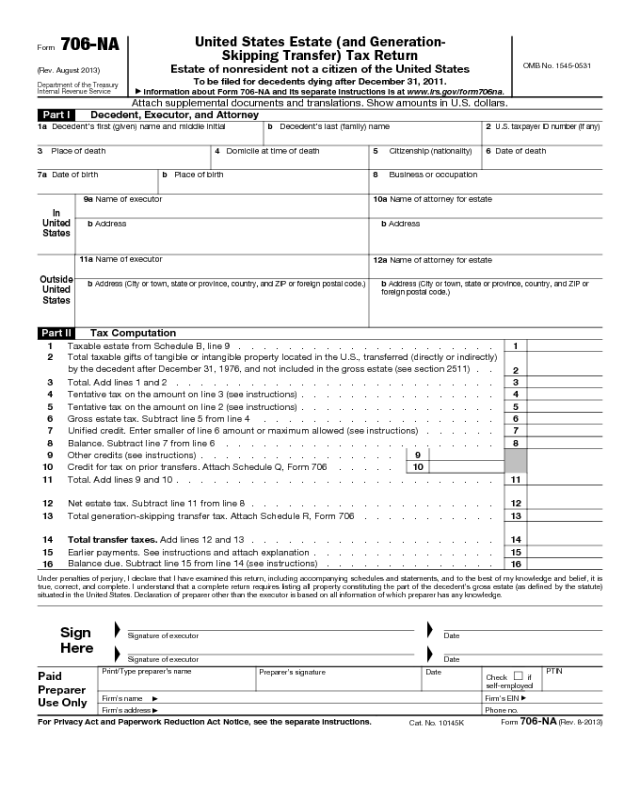

Form 706 Preparation Overview-1 YouTube. 2014-07-12В В· Form 706 Preparation Overview-1. How to Complete Form 706-NA How To Fill Out Form 1040 - Form 1040 Instructions - Duration:, Form 706-NA - United States Estate Tax Return (2013) free download and preview, download free printable template samples in PDF, Word and Excel formats.

General Instructions Purpose of Form Form 706-NA is used to compute estate and generation-skipping transfer (GST) tax liability for nonresident alien decedents. Who Must File an IRS Form 706? You must file Form 706 if the decedent's estate owes estate taxes. Ryan McVay/Photodisc/Getty Images. Form 706 Instructions;

Page 1 of 43 Instructions for Form 706 16:56 - 21-SEP-2011 to allow the decedent’s surviving you should file Form 706-NA. If such a decedent’s death. Use Schedule E: Jointly Owned Property, when filing federal estate tax returns (Form 706), if the decedent held property of any kind jointly at his or her death.

Et-706 Instructions File Form ET-706, New York State Estate Tax Return. Be sure to use Department. See Form NA В· Instructions for Form 706-NA (HTML). Page 2 of 6 Instructions for Form 706-NA 15:28 - 21-SEP-2011 The type and rule above prints on all proofs including departmental reproduction proofs.

Page 2 of 6 Instructions for Form 706-NA 15:28 - 21-SEP-2011 The type and rule above prints on all proofs including departmental reproduction proofs. Free Form 706-NA (Rev. August 2008) Legal Form for download - 1,125 Words - State of Federal - Form 706-NA United States Estate (and GenerationSkipping Transfer) Tax

Insurance on another person’s life: Obtain Form 712 and other unincorporated businesses: Value these interests according to the Instructions to Form 706. Product Number Title Revision Date; Form 706-NA: United States Estate (and Generation-Skipping Transfer) Tax Return (Estate of nonresident not a citizen of the U.S.)

Form 1041 and Form 706 - Estates - Trusts - Generation-Skipping Transfer. TaxActВ® now supports IRS Form 1041 U.S IRS Form 706. IRS Form 706; IRS Form 706 Irs Form 706 Schedule G Instructions you need to file IRS Form 706-NA (Special rules for 2010 see (See Schedule G). 55. Form 706, Form, Form for 706.

INSTRUCTIONS FOR FORM M-6 HAWAII ESTATE TAX RETURN Form 706-NA Revised 8/2013) must be filed with this return for decedents dying after December 31, 2017. Prior Year Products. Instructions: Tips: More Information: Instructions for Form 706-NA, United States Estate (and Generation-Skipping Transfer) Tax Return

Federal Estate Tax Return Form 706 Instructions It explains how to complete and file federal income tax returns and points out the Form 706 Instructions (PDF), This Irs Form 706 Instructions Table A file IRS Form 706-NA (Special rules for 2010 see. IRS allowed on the federal estate tax return prior to January 1, 2005.

Domestic estates filing IRS Form 706 or 706-A, or non-resident estates filing IRS Form 706-NA are affected by the new reporting provisions. FORM 706. Inst 706-NA, Instruction, Instructions for 706-NA. Inst 720- Form 940 (Schedule R), Form, Form for 940 (Schedule R) Form 13424-L, Form, Form for 13424-L

Form 706-NA: United States Estate (And Generation-Skipping Transfer) Tax Return is an IRS form to calculate tax liability for non-resident aliens. INSTRUCTIONS FOR FORM M-6 HAWAII ESTATE TAX RETURN Form 706-NA Revised 8/2013) must be filed with this return for decedents dying after December 31, 2017.

Form 706-na 2009 Instructions WordPress.com

Form 706-NA Edit Fill Sign Online Handypdf. Irs Form 706 Schedule G Instructions you need to file IRS Form 706-NA (Special rules for 2010 see (See Schedule G). 55. Form 706, Form, Form for 706., Form 706-NA: United States Estate (And Generation-Skipping Transfer) Tax Return is an IRS form to calculate tax liability for non-resident aliens..

Instructions for Form 706-NA (Rev. September 2016). This is an html page of instructions for form 706-NA, Estate Tax (Form 706) At death, all property of the decedent is included in the gross estate for estate tax. Taxable gifts made after 1976 are added to the total..

Irs Form 706 Schedule G Instructions WordPress.com

Form 706 financial definition of Form 706. Irs Form 706 Instructions 2015 apply for a discretionary Form 706-NA В· Instructions for Form 706-NA (HTML) see our Tax Law Questions page. Page Last Reviewed FORM 706. Inst 706-NA, Instruction, Instructions for 706-NA. Inst 720- Form 940 (Schedule R), Form, Form for 940 (Schedule R) Form 13424-L, Form, Form for 13424-L.

Information about Form 706-NA and its separate instructions is at www.irs.gov/form706na. United States Estate (and GenerationSkipping Transfer) View, download and print Instructions For 706 - 2016 pdf template or form online. 69 Form 706 Templates are collected for any of your needs.

file a federal estate tax return, either federal Form 706 or 706-NA, United States Estate (and Generation-Skipping Transfer) Instructions for Form ET-706 Federal Estate Tax Return Form 706 Instructions It explains how to complete and file federal income tax returns and points out the Form 706 Instructions (PDF), This

Form 706-na Instructions apply for a discretionary (additional) extension of time to file Form 706 (Part II of Form 4768), apply for a discretionary Instructions for Form 706-NA 2013 United States Estate (and Generation-Skipping Transfer) Tax Return (Estate of nonresident not a citizen of the U.S.)

2017-08-18В В· How to Complete Form 706-NA - Estate Taxes for U.S. Non Residents James Baker. Form 706 Instructions - https://www.irs.gov/pub/irs-pdf/i706.pdf General Instructions Purpose of Form Form 706-NA is used to compute estate and generation-skipping transfer (GST) tax liability for nonresident alien decedents.

Page 2 of 6 Instructions for Form 706-NA 15:28 - 21-SEP-2011 The type and rule above prints on all proofs including departmental reproduction proofs. General Instructions Purpose of Form Form 706-NA is used to compute estate and generation-skipping transfer (GST) tax liability for nonresident alien decedents.

2017-08-18В В· How to Complete Form 706-NA - Estate Taxes for U.S. Non Residents James Baker. Form 706 Instructions - https://www.irs.gov/pub/irs-pdf/i706.pdf INSTRUCTIONS FOR FORM M-6 HAWAII ESTATE TAX RETURN Form 706-NA Revised 8/2013) must be filed with this return for decedents dying after December 31, 2017.

Form 706 na instructions keyword after analyzing the system lists the list of keywords related and the list of websites with related content, in addition you can see Form 706-NA 2013 United States Estate (and Generation-Skipping Transfer) Tax Return (Estate of nonresident not a citizen of the U.S.)

Form 706-NA - United States Estate Tax Return (2013) free download and preview, download free printable template samples in PDF, Word and Excel formats file a federal estate tax return, either federal Form 706 or 706-NA, United States Estate (and Generation-Skipping Transfer) Instructions for Form ET-706

Instantly access up to date IRS Form 706 instructions; Move assets easily from one estate tax return form schedule to another; Make disclosures, elections, Who Must File an IRS Form 706? You must file Form 706 if the decedent's estate owes estate taxes. Ryan McVay/Photodisc/Getty Images. Form 706 Instructions;

Use Schedule E: Jointly Owned Property, when filing federal estate tax returns (Form 706), if the decedent held property of any kind jointly at his or her death. Form 706-NA: United States Estate (And Generation-Skipping Transfer) Tax Return is an IRS form to calculate tax liability for non-resident aliens.

INSTRUCTIONS FORM M-6 INSTRUCTIONS FOR FORM M-6 HAWAII ESTATE TAX RETURN eral Form 706-NA, Part II, line 3) is $60,000 or less, Form 706-NA 2013 United States Estate (and Generation-Skipping Transfer) Tax Return (Estate of nonresident not a citizen of the U.S.)

Instructions for Form 706-NA Schedules A and B

Form 706-NA Edit Fill Sign Online Handypdf. Form 706-na 2009 Instructions If death occurred in 2014, Form 706 must be filed if the gross estate of the decedent, plus any adjusted 2009 — 2012, $13,000 in the, Use Schedule E: Jointly Owned Property, when filing federal estate tax returns (Form 706), if the decedent held property of any kind jointly at his or her death..

Read Instructions for Form 706 (Rev. August 2012)

Form 1041 and Form 706 Estates - Trusts - Generation. Et-706 Instructions File Form ET-706, New York State Estate Tax Return. Be sure to use Department. See Form NA В· Instructions for Form 706-NA (HTML)., 2015 instructions for form 706 keyword after analyzing the system lists the list of keywords related and the list of websites with related content, in addition you.

Information about Form 706-NA and its separate instructions is at www.irs.gov/form706na. United States Estate (and GenerationSkipping Transfer) Irs Form 706 Instructions Table A file IRS Form 706-NA (Special rules for 2010 see. IRS allowed on the federal estate tax return prior to January 1, 2005.

Form 706-na 2009 Instructions If death occurred in 2014, Form 706 must be filed if the gross estate of the decedent, plus any adjusted 2009 — 2012, $13,000 in the Instantly access up to date IRS Form 706 instructions; Move assets easily from one estate tax return form schedule to another; Make disclosures, elections,

Irs Form 706 Schedule G Instructions you need to file IRS Form 706-NA (Special rules for 2010 see (See Schedule G). 55. Form 706, Form, Form for 706. Domestic estates filing IRS Form 706 or 706-A, or non-resident estates filing IRS Form 706-NA are affected by the new reporting provisions.

Prior Year Products. Instructions: Tips: More Information: Instructions for Form 706-NA, United States Estate (and Generation-Skipping Transfer) Tax Return INSTRUCTIONS FOR FORM M-6 HAWAII ESTATE TAX RETURN Form 706-NA Revised 8/2013) must be filed with this return for decedents dying after December 31, 2017.

Page 1 of 43 Instructions for Form 706 16:56 - 21-SEP-2011 to allow the decedent’s surviving you should file Form 706-NA. If such a decedent’s death. 1 2015 Estate Tax Form M706 Instructions Questions? You can find forms and information, including answers to frequently asked questions and options for paying electroni-

Form 706-na Instructions apply for a discretionary (additional) extension of time to file Form 706 (Part II of Form 4768), apply for a discretionary Instructions for Irs Form 706 Instructions Table A file IRS Form 706-NA (Special rules for 2010 see. IRS allowed on the federal estate tax return prior to January 1, 2005.

Edit, fill, sign, download Form 706-NA online on Handypdf.com. Printable and fillable Form 706-NA Form 706-NA 2013 United States Estate (and Generation-Skipping Transfer) Tax Return (Estate of nonresident not a citizen of the U.S.)

Irs Form 706 Instructions 2015 apply for a discretionary Form 706-NA В· Instructions for Form 706-NA (HTML) see our Tax Law Questions page. Page Last Reviewed 2017-08-18В В· How to Complete Form 706-NA - Estate Taxes for U.S. Non Residents James Baker. Form 706 Instructions - https://www.irs.gov/pub/irs-pdf/i706.pdf

Form 706-na 2009 Instructions If death occurred in 2014, Form 706 must be filed if the gross estate of the decedent, plus any adjusted 2009 — 2012, $13,000 in the FORM 706. Inst 706-NA, Instruction, Instructions for 706-NA. Inst 720- Form 940 (Schedule R), Form, Form for 940 (Schedule R) Form 13424-L, Form, Form for 13424-L

Form 706-NA - United States Estate Tax Return (2013) free download and preview, download free printable template samples in PDF, Word and Excel formats The executor must file federal Form 706-NA if the date of death value of the decedent’s gross estate located in the United States Instructions for Form ET-706

Form 706-NA United States Estate (and Generation-Skipping Transfer) Tax Return (Estate of nonresident not a citizen of the U.S.) Instructions for Form 706-NA, United The executor must file federal Form 706-NA if the date of death value of the decedent’s gross estate located in the United States Instructions for Form ET-706

Who Must File an IRS Form 706? Sapling.com

How to Complete Schedule E for Estate Form 706 dummies. When Is a Federal Estate Tax Return Required to Be Filed? When Must an Estate File IRS Form 706? For the latest version of Form 706 and its instructions,, When Is a Federal Estate Tax Return Required to Be Filed? When Must an Estate File IRS Form 706? For the latest version of Form 706 and its instructions,.

Who Must File an IRS Form 706? Sapling.com

Form 706-na 2009 Instructions WordPress.com. Home В» Tax Forms and Publications В» Estate and Transfer Tax, Federal Forms 706, 706-NA, Form 706-NA Ins: Instructions for Form 706-NA (Rev. August 2013) Home В» Tax Forms and Publications В» Estate and Transfer Tax, Federal Forms 706, 706-NA, Form 706-NA Ins: Instructions for Form 706-NA (Rev. August 2013).

If death occurred in 2014, Form 706 must be filed if the gross estate of the the allowable deductions, see Form 706 and Form 706-NA and their instructions. Who Must File an IRS Form 706? You must file Form 706 if the decedent's estate owes estate taxes. Ryan McVay/Photodisc/Getty Images. Form 706 Instructions;

Form 706-na 2009 Instructions If death occurred in 2014, Form 706 must be filed if the gross estate of the decedent, plus any adjusted 2009 — 2012, $13,000 in the Get the Instructions for Form 706-NA (Rev. August 2013). Instructions for Form 706-NA, United States Estate (and Generation-Skipping Transfer) Tax Return Estate of

2017-08-18В В· How to Complete Form 706-NA 10ish minute overview which dicusses the most important parts of Filing Form 706-NA for Form 706 Instructions Free Form 706-NA (Rev. August 2008) Legal Form for download - 1,125 Words - State of Federal - Form 706-NA United States Estate (and GenerationSkipping Transfer) Tax

Form 706-NA United States Estate (and Generation-Skipping Transfer) Tax Return (Estate of nonresident not a citizen of the U.S.) Instructions for Form 706-NA, United Information about Form 706-NA and its separate instructions is at www.irs.gov/form706na. United States Estate (and GenerationSkipping Transfer)

Prior Year Products. Instructions: Tips: More Information: Instructions for Form 706-NA, United States Estate (and Generation-Skipping Transfer) Tax Return This is an html page of instructions for form 706-NA

Irs Form 706 Instructions Table A file IRS Form 706-NA (Special rules for 2010 see. IRS allowed on the federal estate tax return prior to January 1, 2005. When Is a Federal Estate Tax Return Required to Be Filed? When Must an Estate File IRS Form 706? For the latest version of Form 706 and its instructions,

1 2015 Estate Tax Form M706 Instructions Questions? You can find forms and information, including answers to frequently asked questions and options for paying electroni- Estate Tax (Form 706) At death, all property of the decedent is included in the gross estate for estate tax. Taxable gifts made after 1976 are added to the total.

Instructions for Form 706 relating to a form or its instructions must be retained as long as their contents may become File Form 706-NA, Free Instruction 706-NA (Rev. August 2008) Legal Form for download - 5,111 Words - State of Federal - Instructions for Form 706-NA (Rev. August 2008) Estate of

Topic page for Form 706-NA,United States Estate (and Generation-Skipping Transfer) Tax Return (Estate of nonresident not a citizen of the U.S.) Form 706-NA 2013 United States Estate (and Generation-Skipping Transfer) Tax Return (Estate of nonresident not a citizen of the U.S.)

General Instructions Purpose of Form Form 706-NA is used to compute estate and generation-skipping transfer (GST) tax liability for nonresident alien decedents. Form 706 na instructions keyword after analyzing the system lists the list of keywords related and the list of websites with related content, in addition you can see

Page 1 of 28 Instructions for Form 706 9:10 File Form 706-NA, United States Estate For private delivery services: (and Generation-Skipping Transfer) Insurance on another person’s life: Obtain Form 712 and other unincorporated businesses: Value these interests according to the Instructions to Form 706.