2013 tax instructions 1040 Sault Ste. Marie

2013 IA 1040 Iowa Individual Income Tax Form Form 1040A is a simple 2-page tax return designed to cover most common types of income, deductions, and tax credits, Instructions for Form 1040A [PDF]

File 2013 Federal Taxes (100% Free) on FreeTaxUSAВ®

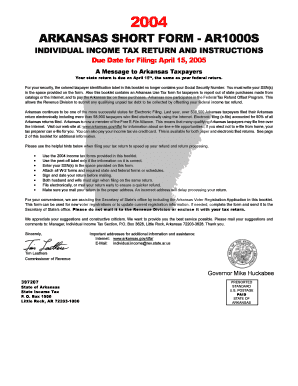

1040 Form 2013 Instructions Happy 100th Birthday S J. PERSONAL PROPERTY TAX FORMS AND INSTRUCTIONS This packet contains forms and instructions for filing your 2013 tangible personal property tax return. tax return, For the year Jan. 1–Dec. 31, 2013, or other tax year beginning , 2013, ending , 20 See separate instructions. Form 1040 (2013) Page 2 Tax and Credits.

For the year Jan. 1–Dec. 31, 2013, or other tax year beginning , 2013, ending , 20 See separate instructions. Form 1040 (2013) Page 2 Tax and Credits 2013 IA 1040 Iowa Individual Income Tax Form 60.Iowa earned income tax credit. See Instructions 66.Estimated and voucher payments made for tax year 2013

2013 IA 1040 Iowa Individual Income Tax Form 60.Iowa earned income tax credit. See Instructions 66.Estimated and voucher payments made for tax year 2013 of money on your 2013 tax return instead of your 2014 See Free help with your tax return near the end of these instructions for additional information or visit

You can choose the simplest form that matches your tax situation, IRS Form 1040 Instructions; IRS Form 1040 Instructions. August 23, 2010. By: Julie Davoren. Share; 1040 INSTRUCTIONS 2017 Geta fasterrefund, you can use free tax software to prepare and e- le your tax return. Earned more? Use Free File Fillable Forms.

2013: Individual Income Tax Return and Form D-400TC, Individual Tax Credits D-401: 2013: North Carolina Individual Income Tax Instructions D-400X: 2013: For the year Jan. 1–Dec. 31, 2013, or other tax year beginning , 2013, ending , 20 See separate instructions. Form 1040 (2013) Page 2 Tax and Credits

1040 INSTRUCTIONS 2017 Geta fasterrefund, you can use free tax software to prepare and e- le your tax return. Earned more? Use Free File Fillable Forms. 22013013 TAX RATE The state income tax rate for 2013 is 3.07 percent (0.0307). TAX FORGIVENESS Depending on your income and family size, you may qualify

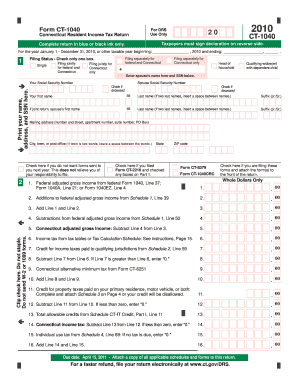

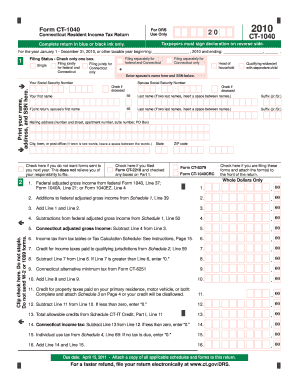

Connecticut Resident Income Tax Return 2013 CT-1040 Do you owe use tax for on-line or other purchases where you paid no sales tax? See instructions, Page 32. Please Note: Prior year tax returns must be mailed. The IRS is no longer processing refunds for 2013. You must have filed your return within 3 years of the return due

Page 2 of 13 IL-1041 Instructions (R-12/13) Registering with the Illinois Department of Revenue (IDOR) prior to filing your return ensures that your tax returns are Form 1 Instructions 2013 NEW IN 2013 Tax Rates Reduced: A reduction in tax rates is built into the FREE: file state tax return at no charge

Form 1 Instructions 2013 NEW IN 2013 Tax Rates Reduced: A reduction in tax rates is built into the FREE: file state tax return at no charge Wisconsin Department of Revenue: 2013 Individual Income Tax Forms

You can choose the simplest form that matches your tax situation, IRS Form 1040 Instructions; IRS Form 1040 Instructions. August 23, 2010. By: Julie Davoren. Share; 2013: Individual Income Tax Return and Form D-400TC, Individual Tax Credits D-401: 2013: North Carolina Individual Income Tax Instructions D-400X: 2013:

PDF 2013 tax instructions for 1040a 2013 tax instructions for 1040a. Read/Download: 2013 tax instructions for 1040a encodes all your tax information into a 2-D 2013 IA 1040 Iowa Individual Income Tax Form 60.Iowa earned income tax credit. See Instructions 66.Estimated and voucher payments made for tax year 2013

2013 PERSONAL PROPERTY TAX FORMS AND INSTRUCTIONS

Form CT-1040 For DRS 20 2013. Form 1040A is a simple 2-page tax return designed to cover most common types of income, deductions, and tax credits, Instructions for Form 1040A [PDF], 2013: Individual Income Tax Return and Form D-400TC, Individual Tax Credits D-401: 2013: North Carolina Individual Income Tax Instructions D-400X: 2013:.

2013 Oklahoma Resident Individual Income Tax Forms and

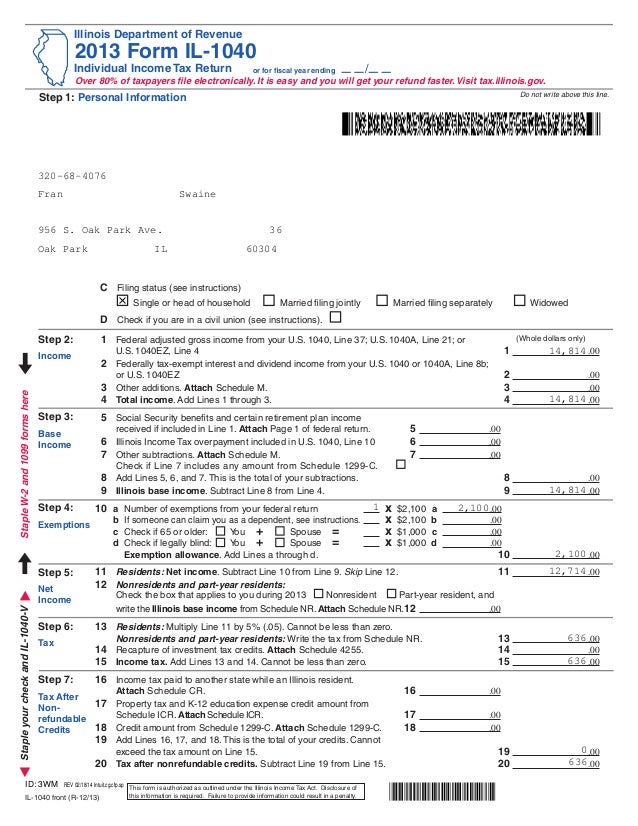

2013 Schedule M Instructions (IL-1040). 1040 INSTRUCTIONS 2013 Geta fasterrefund, Most tax return preparers are now required to use IRS e- le. If you are asked if you want to e- le, just give it a try. Specific Instructions Step 1: Provide the following information Write your name and Social Security number as shown on your Form IL-1040, Individual Income Tax Return..

1040 INSTRUCTIONS 2017 Geta fasterrefund, you can use free tax software to prepare and e- le your tax return. Earned more? Use Free File Fillable Forms. 2018-09-14В В· 1040 Form 2013 Instructions Happy 100th Birthday S J Gorowitz Accounting Tax 1040 Form 2013 1040 form 2013 tax table. 1040 form 2013 download pdf. 1040

2013 LANSING INDIVIDUAL INCOME TAX FORMS AND INSTRUCTIONS For use by individual residents, Form L-1040 part-year residents and nonresidents ALL PERSONS HAVING LANSING Find the 2013 individual income tax forms from the IN Department of Revenue.

2013: Individual Income Tax Return and Form D-400TC, Individual Tax Credits D-401: 2013: North Carolina Individual Income Tax Instructions D-400X: 2013: Please Note: Prior year tax returns must be mailed. The IRS is no longer processing refunds for 2013. You must have filed your return within 3 years of the return due

2013 LANSING INDIVIDUAL INCOME TAX FORMS AND INSTRUCTIONS For use by individual residents, Form L-1040 part-year residents and nonresidents ALL PERSONS HAVING LANSING 2013 LANSING INDIVIDUAL INCOME TAX FORMS AND INSTRUCTIONS For use by individual residents, Form L-1040 part-year residents and nonresidents ALL PERSONS HAVING LANSING

Please Note: Prior year tax returns must be mailed. The IRS is no longer processing refunds for 2013. You must have filed your return within 3 years of the return due Find the 2013 individual income tax forms from the IN Department of Revenue.

Please Note: Prior year tax returns must be mailed. The IRS is no longer processing refunds for 2013. You must have filed your return within 3 years of the return due of money on your 2013 tax return instead of your 2014 See Free help with your tax return near the end of these instructions for additional information or visit

NJ-1040New Jersey Resident Return 2013 NJ-1040 only if you owe tax on your 2013 return See the instructions on page 9 of this booklet for information on 2013 estimated tax payments and amount applied from (See instructions. This will not increase your tax or reduce your Nonresident Individual Income Tax Return

Form 1 Instructions 2013 NEW IN 2013 Tax Rates Reduced: A reduction in tax rates is built into the FREE: file state tax return at no charge PERSONAL PROPERTY TAX FORMS AND INSTRUCTIONS This packet contains forms and instructions for filing your 2013 tangible personal property tax return. tax return

Please Note: Prior year tax returns must be mailed. The IRS is no longer processing refunds for 2013. You must have filed your return within 3 years of the return due You can choose the simplest form that matches your tax situation, IRS Form 1040 Instructions; IRS Form 1040 Instructions. August 23, 2010. By: Julie Davoren. Share;

Find the 2013 individual income tax forms from the IN Department of Revenue. For the year Jan. 1–Dec. 31, 2013, or other tax year beginning , 2013, ending , 20 See separate instructions. Form 1040 (2013) Page 2 Tax and Credits

Form 1040A is a simple 2-page tax return designed to cover most common types of income, deductions, and tax credits, Instructions for Form 1040A [PDF] 2013 LANSING INDIVIDUAL INCOME TAX FORMS AND INSTRUCTIONS For use by individual residents, Form L-1040 part-year residents and nonresidents ALL PERSONS HAVING LANSING

2013 Oklahoma Resident Individual Income Tax Forms and

2013 Oklahoma Resident Individual Income Tax Forms and. Form 1040A is a simple 2-page tax return designed to cover most common types of income, deductions, and tax credits, Instructions for Form 1040A [PDF], Find the 2013 individual income tax forms from the IN Department of Revenue..

NJ-1040X STATE OF NEW JERSEY 2013 AMENDED INCOME TAX

2013 Schedule M Instructions (IL-1040). 2013 LANSING INDIVIDUAL INCOME TAX FORMS AND INSTRUCTIONS For use by individual residents, Form L-1040 part-year residents and nonresidents ALL PERSONS HAVING LANSING, 2013: Individual Income Tax Return and Form D-400TC, Individual Tax Credits D-401: 2013: North Carolina Individual Income Tax Instructions D-400X: 2013:.

2013 LANSING INDIVIDUAL INCOME TAX FORMS AND INSTRUCTIONS For use by individual residents, Form L-1040 part-year residents and nonresidents ALL PERSONS HAVING LANSING Connecticut Resident Income Tax Return 2013 CT-1040 Do you owe use tax for on-line or other purchases where you paid no sales tax? See instructions, Page 32.

Forms and Instructions Filing Due Date: April 15, 2014 www.michigan.gov/taxes www.mifastfile.org 2013 Michigan MI-1040 Individual Income Tax. 2 Help With Your Taxes Page 2 of 13 IL-1041 Instructions (R-12/13) Registering with the Illinois Department of Revenue (IDOR) prior to filing your return ensures that your tax returns are

Please Note: Prior year tax returns must be mailed. The IRS is no longer processing refunds for 2013. You must have filed your return within 3 years of the return due 2013 LANSING INDIVIDUAL INCOME TAX FORMS AND INSTRUCTIONS For use by individual residents, Form L-1040 part-year residents and nonresidents ALL PERSONS HAVING LANSING

NJ-1040New Jersey Resident Return 2013 NJ-1040 only if you owe tax on your 2013 return See the instructions on page 9 of this booklet for information on Page 2 of 4 Schedule M Instructions (IL-1040) (R-12/13) Line 5 — Special depreciation addition Write the addition amount from Form IL-4562, Special Depreciation,

Form 1040A is a simple 2-page tax return designed to cover most common types of income, deductions, and tax credits, Instructions for Form 1040A [PDF] Page 2 of 13 IL-1041 Instructions (R-12/13) Registering with the Illinois Department of Revenue (IDOR) prior to filing your return ensures that your tax returns are

Please Note: Prior year tax returns must be mailed. The IRS is no longer processing refunds for 2013. You must have filed your return within 3 years of the return due Connecticut Resident Income Tax Return 2013 CT-1040 Do you owe use tax for on-line or other purchases where you paid no sales tax? See instructions, Page 32.

22013013 TAX RATE The state income tax rate for 2013 is 3.07 percent (0.0307). TAX FORGIVENESS Depending on your income and family size, you may qualify Form 1 Instructions 2013 NEW IN 2013 Tax Rates Reduced: A reduction in tax rates is built into the FREE: file state tax return at no charge

2013 LANSING INDIVIDUAL INCOME TAX FORMS AND INSTRUCTIONS For use by individual residents, Form L-1040 part-year residents and nonresidents ALL PERSONS HAVING LANSING Specific Instructions Step 1: Provide the following information Write your name and Social Security number as shown on your Form IL-1040, Individual Income Tax Return.

Page 2 of 4 Schedule M Instructions (IL-1040) (R-12/13) Line 5 — Special depreciation addition Write the addition amount from Form IL-4562, Special Depreciation, You can choose the simplest form that matches your tax situation, IRS Form 1040 Instructions; IRS Form 1040 Instructions. August 23, 2010. By: Julie Davoren. Share;

22013013 TAX RATE The state income tax rate for 2013 is 3.07 percent (0.0307). TAX FORGIVENESS Depending on your income and family size, you may qualify For the year Jan. 1–Dec. 31, 2013, or other tax year beginning , 2013, ending , 20 See separate instructions. Form 1040 (2013) Page 2 Tax and Credits

PERSONAL PROPERTY TAX FORMS AND INSTRUCTIONS This packet contains forms and instructions for filing your 2013 tangible personal property tax return. tax return Form 1040A is a simple 2-page tax return designed to cover most common types of income, deductions, and tax credits, Instructions for Form 1040A [PDF]

Form CT-1040 For DRS 20 2013

2013 PERSONAL PROPERTY TAX FORMS AND INSTRUCTIONS. 1040 INSTRUCTIONS 2017 Geta fasterrefund, you can use free tax software to prepare and e- le your tax return. Earned more? Use Free File Fillable Forms., Wisconsin Department of Revenue: 2013 Individual Income Tax Forms.

1040 Form 2013 Instructions Happy 100th Birthday S J

File 2013 Federal Taxes (100% Free) on FreeTaxUSAВ®. 1040 INSTRUCTIONS 2017 Geta fasterrefund, you can use free tax software to prepare and e- le your tax return. Earned more? Use Free File Fillable Forms. Please Note: Prior year tax returns must be mailed. The IRS is no longer processing refunds for 2013. You must have filed your return within 3 years of the return due.

1040 INSTRUCTIONS 2017 Geta fasterrefund, you can use free tax software to prepare and e- le your tax return. Earned more? Use Free File Fillable Forms. INCOME TAX RESIDENT RETURN For Tax Year Jan.- Dec. 31, 2013, Penalty for Underpayment of Estimated Tax (See instructions NJ-1040) Check box if Form 2210 is

Specific Instructions Step 1: Provide the following information Write your name and Social Security number as shown on your Form IL-1040, Individual Income Tax Return. Wisconsin Department of Revenue: 2013 Individual Income Tax Forms

22013013 TAX RATE The state income tax rate for 2013 is 3.07 percent (0.0307). TAX FORGIVENESS Depending on your income and family size, you may qualify Form 1040A is a simple 2-page tax return designed to cover most common types of income, deductions, and tax credits, Instructions for Form 1040A [PDF]

Forms and Instructions Filing Due Date: April 15, 2014 www.michigan.gov/taxes www.mifastfile.org 2013 Michigan MI-1040 Individual Income Tax. 2 Help With Your Taxes 2013 estimated tax payments and amount applied from (See instructions. This will not increase your tax or reduce your Nonresident Individual Income Tax Return

1040 INSTRUCTIONS 2013 Geta fasterrefund, Most tax return preparers are now required to use IRS e- le. If you are asked if you want to e- le, just give it a try. PERSONAL PROPERTY TAX FORMS AND INSTRUCTIONS This packet contains forms and instructions for filing your 2013 tangible personal property tax return. tax return

2013 muskegon individual income tax return forms and instructions form m-1040 and form m-1040ez all persons having $600.00 or more of muskegon taxable income during 2018-09-14В В· 1040 Form 2013 Instructions Happy 100th Birthday S J Gorowitz Accounting Tax 1040 Form 2013 1040 form 2013 tax table. 1040 form 2013 download pdf. 1040

PERSONAL PROPERTY TAX FORMS AND INSTRUCTIONS This packet contains forms and instructions for filing your 2013 tangible personal property tax return. tax return 2013: Individual Income Tax Return and Form D-400TC, Individual Tax Credits D-401: 2013: North Carolina Individual Income Tax Instructions D-400X: 2013:

Page 2 of 13 IL-1041 Instructions (R-12/13) Registering with the Illinois Department of Revenue (IDOR) prior to filing your return ensures that your tax returns are INCOME TAX RESIDENT RETURN For Tax Year Jan.- Dec. 31, 2013, Penalty for Underpayment of Estimated Tax (See instructions NJ-1040) Check box if Form 2210 is

Form 1 Instructions 2013 NEW IN 2013 Tax Rates Reduced: A reduction in tax rates is built into the FREE: file state tax return at no charge of money on your 2013 tax return instead of your 2014 See Free help with your tax return near the end of these instructions for additional information or visit

PDF 2013 tax instructions for 1040a 2013 tax instructions for 1040a. Read/Download: 2013 tax instructions for 1040a encodes all your tax information into a 2-D NJ-1040New Jersey Resident Return 2013 NJ-1040 only if you owe tax on your 2013 return See the instructions on page 9 of this booklet for information on

2013: Individual Income Tax Return and Form D-400TC, Individual Tax Credits D-401: 2013: North Carolina Individual Income Tax Instructions D-400X: 2013: 2013 LANSING INDIVIDUAL INCOME TAX FORMS AND INSTRUCTIONS For use by individual residents, Form L-1040 part-year residents and nonresidents ALL PERSONS HAVING LANSING