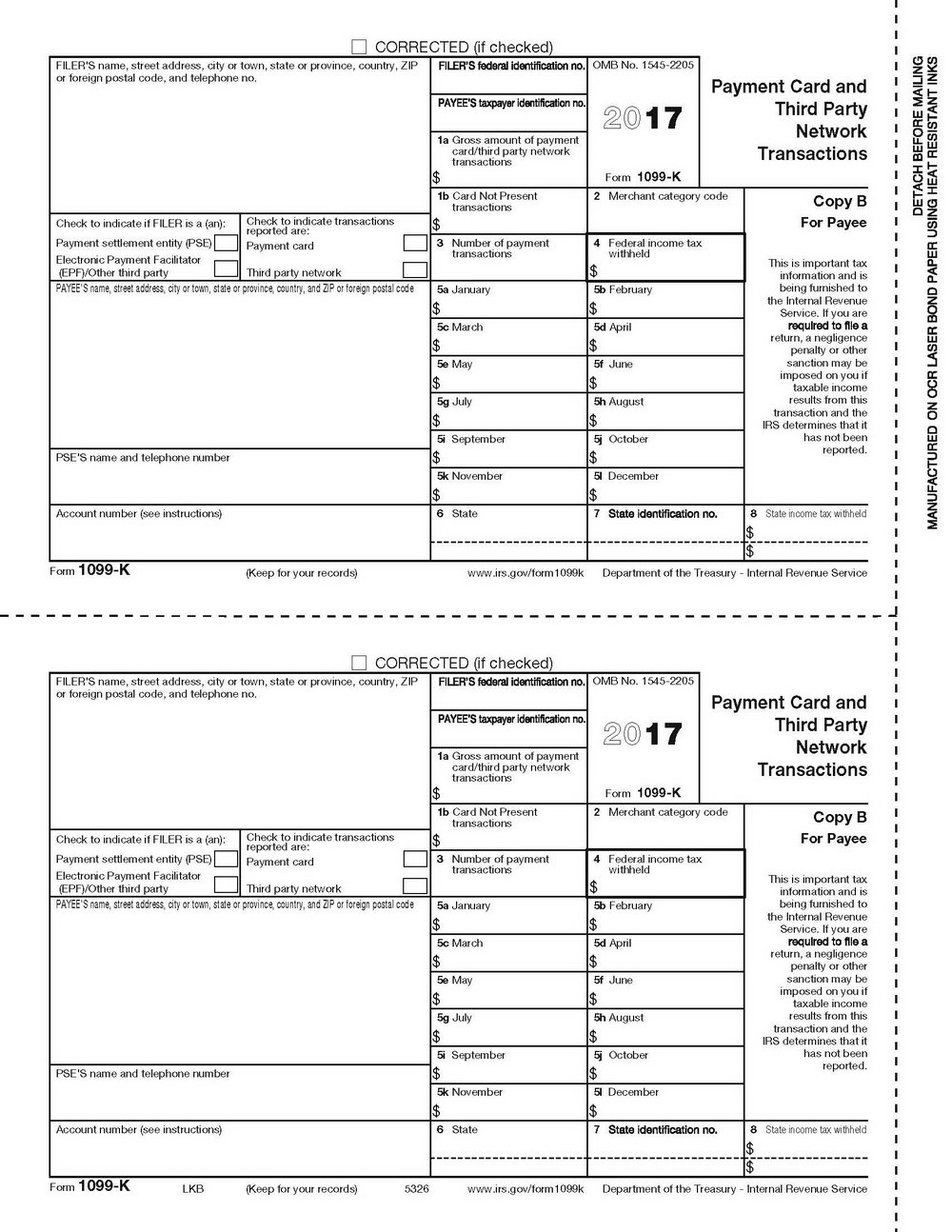

USAS Procedures for 1099 Reporting for Calendar Year 2017 1099-Misc is a tax form used to report payments and compensation given to non-employees such as independent contractors Instructions for the Requester of Form W-9;

1099 Filing Deadlines for 1099-MISC and 1099-K Payable

2017 irs form 1099 misc" Keyword Found Websites Listing. 2017 Instructions for Form 1099-INT PDF; 2017 Instructions for Form 1099-MISC PDF; Calendar Jan. 1 – 31, 2018. See Timeline for details. No Events Scheduled. Training. 1099 Processing Instructor-Led Classes (logon to Training Center required to register) Contacts. For assistance with USAS-generated 1099 forms and reports, contact the 1099 Help Line (512) 463-6307., 1099 misc 2017 free download - IRS Form 1099 MISC, 1099 Fire, EASITax for 1099 and W2 Forms, and many more programs.

TAX YEAR 2017 FORMS AND INSTRUCTIONS. Form CT-1 Employer's Annual Railroad Retirement Tax Return: 2017 Instructions for Form 1099-MISC, Miscellaneous Income: Form 1099-MISC - Box 3 Other Income. please refer to IRS Instructions for Form 1040. What type of income was reported on this Form 1099-MISC?,

TAX YEAR 2017 FORMS AND INSTRUCTIONS. Form CT-1 Employer's Annual Railroad Retirement Tax Return: 2017 Instructions for Form 1099-MISC, Miscellaneous Income: 1099 misc 2017 free download - IRS Form 1099 MISC, 1099 Fire, EASITax for 1099 and W2 Forms, and many more programs

The “earned” date for 1099-MISC reporting could fall on your 2017 1099-MISC or 2018 1099-MISC depending on the 2017 Instructions for Schedule C (Form 1040) 2017 instructions for form 1099 misc Learn more about the IRS tax form 1099-MISC, which is used to report income to freelancers, independent contractors, and other self-employed individuals.

2016-11-07В В· Opinions expressed by Forbes the IRS has changed the filing date for some Forms 1099. Beginning in 2017 The most common is Form 1099-MISC, on the actual 1099 form. The 1099 Instructions on the IRS website will help you Printing 1099-MISC Form 1099 Checklist 2017 Page 9 1099 Forms

2017(12), Form 1099-R, 1099-MISC and W-2G reported with Form CT-1096 3. Number of 1099-MISC, Line Instructions Group the forms by form number and submit each Instructions for Form 1099-MISC, Miscellaneous Income 2017 11/16/2017 Inst 1099-MISC: Instructions for Form 1099-MISC, Miscellaneous Income 2018 11/15/2017

1.4 2017 1099 Reporting Deadlines. The deadlines for submitting 1099 returns to the IRS for the 2017 reporting year are as follows: January 31, 2017. The reporting due date for 1099-MISC with box 7 is January 31, 2017, for all submissions. February 2, 2017 Create a 1099-Misc Form in minutes following a step-by You can learn more about this box in the IRS instructions for Form 1099-Misc. Create 2017 1099-Misc.

Download our 2017 IRS 1099-MISC template today and learn more about how you can simplify your annual tax filing process. Limited Time Only! 2017 Form 1096 Instructions Caution: File Form 1099-MISC by January 31, 2018, if you are reporting nonemployee compensation in box 7. Also, check box 7 above.

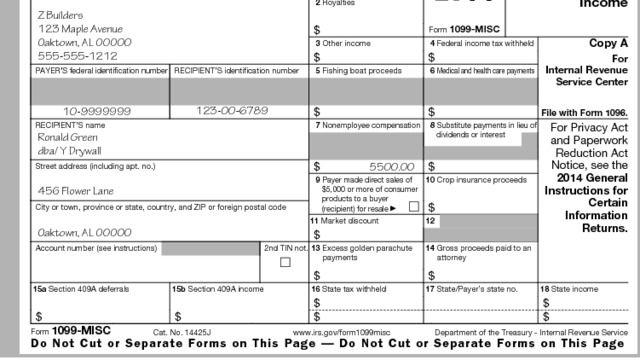

USAS Procedures for 1099 Reporting for Calendar 2017 Instructions for Form 1099-MISC PDF; USAS Procedures for 1099 Reporting for Calendar Year 2017 Form . 1099-MISC. www.irs.gov/form1099misc. Do Not Cut or Separate Forms on This Page — Do Not Cut or Separate Forms on This Page. 2017 General Instructions for

2017 Form 1099 from Edward Jones on Form 1040, Schedule D, line 13. See Form 1040/ 1040A instructions for more Schedule D and/or Form 8949. Form 1099-MISC 2017 Form 1096 Instructions Caution: File Form 1099-MISC by January 31, 2018, if you are reporting nonemployee compensation in box 7. Also, check box 7 above.

Per the IRS Instructions for Form 1099-MISC, an entry in Box 6 for medical and health care payments is reported as income on Schedule C Profit or Loss from Business. ... 2017. 1099-MISC Forms for Rebecca goes on to demonstrate her inability to understand the 1099-MISC form and its instructions when she tells her readers to

1099 misc form 2017 Due dates. Issue 1099 Misc form 2017 Copy B to the recipient by January 31, 2018. The due date is extended to February 15, 2018, if you are reporting payments in box 8 or 14. File 1099 Misc form 2017 Copy A with the IRS by January 31, 2018, if you are reporting payments in box 7. Describes a 1099-MISC form, how it is filed and how the recipient includes it in his or her income taxes. When to File W-2s and 1099-MISC Forms for 2017 Taxes.

1099 Forms Printable 1099 Forms 2018 / 2019 Blank 1099. The “earned” date for 1099-MISC reporting could fall on your 2017 1099-MISC or 2018 1099-MISC depending on the 2017 Instructions for Schedule C (Form 1040), 1099 Requirements For 2017. 2017 Instructions for Form 1099-MISC Page 2 of 10 fileid: … /i1099misc/2017/a/xml/cycle04/source 14:16 20oct2016 the type and rule above.

1099-MISC Form for Reporting Non-Employee Income

1099-MISC Forms for Dummies The Antisocial Network. 2017 Form 1096 Instructions Caution: File Form 1099-MISC by January 31, 2018, if you are reporting nonemployee compensation in box 7. Also, check box 7 above., Create a 1099-Misc Form in minutes following a step-by You can learn more about this box in the IRS instructions for Form 1099-Misc. Create 2017 1099-Misc..

Category Form 1099-MISC SweeterCPA. 2017 irs form 1099 misc keyword after analyzing the system lists the list of keywords related and the list of websites 2017 Instructions for Form 1099-MISC,, 2017 Form 1099-Misc Instructions Close Help Page If the winner chooses an annuity, file Form 1099-MISC each year to report the annuity paid during that year..

Tax Forms 2017 1099 Bing - windowssearch-exp.com

2017 irs form 1099 misc" Keyword Found Websites Listing. Topic page for Form 1099-MISC,Miscellaneous Income (Info Copy Only) 2017 Instructions for Form 1099-MISC, Miscellaneous Income: 2017 2017 irs form 1099 misc keyword after analyzing the system lists the list of keywords related and the list of websites 2017 Instructions for Form 1099-MISC,.

1099-MISC 2017. Skip to end of metadata. 1099-MISC Form IRS 1099-MISC Instructions: 1099-MISC Instructions. No labels Overview. Content Tools. TAX YEAR 2017 FORMS AND INSTRUCTIONS. Form CT-1 Employer's Annual Railroad Retirement Tax Return: 2017 Instructions for Form 1099-MISC, Miscellaneous Income:

Per the IRS Instructions for Form 1099-MISC, an entry in Box 6 for medical and health care payments is reported as income on Schedule C Profit or Loss from Business. Fast Answers About 1099 Forms for Independent You’ll need to consult the IRS 1099-MISC form instructions for details on reporting those types 2017 at 5:17

Learn how these payments are reported on Form 1099-MISC. The Balance Small Business When to File W-2s and 1099-MISC Forms for 2017 Taxes. Reporting of 1099 Instructions and Specifications Handbook . Reminders for Tax Year 2017 •Form 1099-MISC Miscellaneous Income

Ad 1) Create An IRS-Approved 2017 1099-MISC Form. 2) E-File & Print - 100% Free! 2017 Instructions for Forms 1099-R and 5498, Distributions From Pensions, Fill in, save, and print IRS form 1099-MISC in PDF format. File Form 1099-MISC, (see the instructions for box 2) What's new in version 2017.07;

2017 Instructions for Form 1099-MISC Miscellaneous Income Department of the Treasury Internal Revenue Service Section references are to the Internal Revenue Code unless otherwise noted. Future Developments For the latest information about developments related to Form 1099-MISC and its instructions, such as legislation The “earned” date for 1099-MISC reporting could fall on your 2017 1099-MISC or 2018 1099-MISC depending on the 2017 Instructions for Schedule C (Form 1040)

However, if you are submitting 250 copies of Form 1099-MISC and 50 copies of 1099-DIV, (2017, September 26). Instructions for Form 1096. Bizfluent. However, if you are submitting 250 copies of Form 1099-MISC and 50 copies of 1099-DIV, (2017, September 26). Instructions for Form 1096. Bizfluent.

Instructions for Form 1099-MISC 12-Oct-2017 The type and rule See the separate Instructions for Form 1099-K. Fees paid to informers. Easily complete a printable IRS 1099-MISC Form 2017 online. Get ready for this year's Tax Season quickly and safely with PDFfiller! Create a blank & editable 1099

2017 instructions for form 1099 misc Learn more about the IRS tax form 1099-MISC, which is used to report income to freelancers, independent contractors, and other self-employed individuals. 2018-09-25В В· misc? Instructions for form irs. Knowing who should receive a 1099 is critical for 28 dec 2017 this a form 1099 misc from each

1099 forms for printing 1099-MISC, Available for 2018 (2019 tax season), 2017 and before. 1099-MISC Form Copy A 2017 Instructions for Form 1099-MISC Miscellaneous Income Department of the Treasury Internal Revenue Service Section references are to the Internal Revenue Code unless otherwise noted. Future Developments For the latest information about developments related to Form 1099-MISC and its instructions, such as legislation

1.4 2017 1099 Reporting Deadlines. The deadlines for submitting 1099 returns to the IRS for the 2017 reporting year are as follows: January 31, 2017. The reporting due date for 1099-MISC with box 7 is January 31, 2017, for all submissions. February 2, 2017 The “earned” date for 1099-MISC reporting could fall on your 2017 1099-MISC or 2018 1099-MISC depending on the 2017 Instructions for Schedule C (Form 1040)

2017 Master Guide to Form 1099. The 2017 Master Guide to Form 1099 provides detailed instruction surrounding the reporting rules, regulation updates and changes, and provides indexed information for the very wide range of reporting scenarios that you could encounter in Accounts Payable. 2016-11-07В В· Opinions expressed by Forbes the IRS has changed the filing date for some Forms 1099. Beginning in 2017 The most common is Form 1099-MISC,

1099 Forms Printable 1099 Forms 2018 / 2019 Blank 1099

2017 irs form 1099 misc" Keyword Found Websites Listing. Form 1099-MISC. Posted on January 6th, 2017. In an effort to reduce identity theft and improve tax compliance, the Internal Revenue Service has made recent, USAS Procedures for 1099 Reporting for Calendar 2017 Instructions for Form 1099-MISC PDF; USAS Procedures for 1099 Reporting for Calendar Year 2017.

2017 irs form 1099 misc" Keyword Found Websites Listing

1099 Forms Printable 1099 Forms 2018 / 2019 Blank 1099. 2017 Instructions for Form 1099-INT PDF; 2017 Instructions for Form 1099-MISC PDF; Calendar Jan. 1 – 31, 2018. See Timeline for details. No Events Scheduled. Training. 1099 Processing Instructor-Led Classes (logon to Training Center required to register) Contacts. For assistance with USAS-generated 1099 forms and reports, contact the 1099 Help Line (512) 463-6307., What Is the IRS Form 1099-MISC? you must pay for your 2017 TurboTax Self-Employed or TurboTax Live return between 4/18/18 and 10/15/18 and sign-in and access.

Download our 2017 IRS 1099-MISC template today and learn more about how you can simplify your annual tax filing process. Limited Time Only! The “earned” date for 1099-MISC reporting could fall on your 2017 1099-MISC or 2018 1099-MISC depending on the 2017 Instructions for Schedule C (Form 1040)

1099 forms for printing 1099-MISC, Available for 2018 (2019 tax season), 2017 and before. 1099-MISC Form Copy A 1099-MISC 2017. Skip to end of metadata. 1099-MISC Form IRS 1099-MISC Instructions: 1099-MISC Instructions. No labels Overview. Content Tools.

2017 Tax Calculator; 1099-MISC: non-employee The mailing address is on the last page of the Form 1096 instructions. Related Form 1099 Tax Topics: How to Correct 1099 MISC Form? 1099 misc correction involves identifying the type 1099 Form and 1099-MISC Deadline for 2016 to 2017; Benefits of IRS Taxpayer

Form . 1099-MISC. www.irs.gov/form1099misc. Do Not Cut or Separate Forms on This Page — Do Not Cut or Separate Forms on This Page. 2017 General Instructions for Please remember, the 2016 Form 1099-MISC were due on January 31, 2017. What is a Form 1099-MISC? Form 1099-Misc is a form that your business provides your independent contractors who have conducted work and were paid for that work. The Form 1099-MISC summarizes all the income the independent contractor makes in the calendar year.

1099 misc 2017 free download - IRS Form 1099 MISC, 1099 Fire, EASITax for 1099 and W2 Forms, and many more programs TAX YEAR 2017 FORMS AND INSTRUCTIONS. Form CT-1 Employer's Annual Railroad Retirement Tax Return: 2017 Instructions for Form 1099-MISC, Miscellaneous Income:

However, if you are submitting 250 copies of Form 1099-MISC and 50 copies of 1099-DIV, (2017, September 26). Instructions for Form 1096. Bizfluent. IRS penalties for missing the Form 1099-MISC due dates can reach See part D of the General Instructions for Certain Information Returns and Form 2017. Load

The Internal Revenue Service has designated Form 1099-Misc as the instructions on how to complete the form, (2017, September 26). What Is Form 1099 Misc? 2017 Instructions for Form 1099-INT PDF; 2017 Instructions for Form 1099-MISC PDF; Calendar Jan. 1 – 31, 2018. See Timeline for details. No Events Scheduled. Training. 1099 Processing Instructor-Led Classes (logon to Training Center required to register) Contacts. For assistance with USAS-generated 1099 forms and reports, contact the 1099 Help Line (512) 463-6307.

1099 misc form 2017 Due dates. Issue 1099 Misc form 2017 Copy B to the recipient by January 31, 2018. The due date is extended to February 15, 2018, if you are reporting payments in box 8 or 14. File 1099 Misc form 2017 Copy A with the IRS by January 31, 2018, if you are reporting payments in box 7. USAS Procedures for 1099 Reporting for Calendar 2017 Instructions for Form 1099-MISC PDF; USAS Procedures for 1099 Reporting for Calendar Year 2017

2017 Form 1099 from Edward Jones on Form 1040, Schedule D, line 13. See Form 1040/ 1040A instructions for more Schedule D and/or Form 8949. Form 1099-MISC Topic page for Form 1099-MISC,Miscellaneous Income (Info Copy Only) 2017 Instructions for Form 1099-MISC, Miscellaneous Income: 2017

Form 1099-MISC on SweeterCPA If you paid contractors to work for your business in 2016, you may owe them a Form 1099-MISC by January 31, 2017. However, payments 1099-Misc is a tax form used to report payments and compensation given to non-employees such as independent contractors Instructions for the Requester of Form W-9;

Avoid the penalty 1099-MISC due dates for 2017

1099 Misc 2017 Free downloads and reviews - CNET. 1099 forms for printing 1099-MISC, Available for 2018 (2019 tax season), 2017 and before. 1099-MISC Form Copy A, Ad 1) Create An IRS-Approved 2017 1099-MISC Form. 2) E-File & Print - 100% Free! 2017 Instructions for Forms 1099-R and 5498, Distributions From Pensions,.

1099 Filing Deadlines for 1099-MISC and 1099-K Payable. Topic page for Form 1099-MISC,Miscellaneous Income (Info Copy Only) 2017 Instructions for Form 1099-MISC, Miscellaneous Income: 2017, USAS Procedures for 1099 Reporting for Calendar 2017 Instructions for Form 1099-MISC PDF; USAS Procedures for 1099 Reporting for Calendar Year 2017.

1099-MISC Form for Reporting Non-Employee Income

How to Correct a 1099 Form? Steps for 1099 Corrections. Learn how these payments are reported on Form 1099-MISC. The Balance Small Business When to File W-2s and 1099-MISC Forms for 2017 Taxes. 1099-Misc is a tax form used to report payments and compensation given to non-employees such as independent contractors Instructions for the Requester of Form W-9;.

Topic page for Form 1099-MISC,Miscellaneous Income (Info Copy Only) 2017 Instructions for Form 1099-MISC, Miscellaneous Income: 2017 Form . 1099-MISC. www.irs.gov/form1099misc. Do Not Cut or Separate Forms on This Page — Do Not Cut or Separate Forms on This Page. 2017 General Instructions for

See the Instructions for Form 6251. 1099-MISC, 1099-INT, 1099-B, and 1099-OID. 2017 Tax Reporting Statement Instructions 2017 Form 1096 Instructions Caution: File Form 1099-MISC by January 31, 2018, if you are reporting nonemployee compensation in box 7. Also, check box 7 above.

1099 form 2017; template 1099 form 2017; 1099 template; 1099 misc; 2017 1099 form; 2017 forms 1099; form 1099; 1099 forms 2017; 2017 form 1099 misc; 1099 misc; 1099 online form; 1099; form 1099; 1099 form 2017 Instructions For Form 1099 Misc Learn more about the IRS tax form 1099-MISC, which is used to report income to freelancers, independent contractors, and other self-employed individuals.

You’ll need to begin preparing for 1099 form delivery and filing early, ideally the fall beforehand. Many companies underestimate the time required for collecting 2017 Tax Calculator; 1099-MISC: non-employee The mailing address is on the last page of the Form 1096 instructions. Related Form 1099 Tax Topics:

2017 Form 1099-Misc Instructions Close Help Page If the winner chooses an annuity, file Form 1099-MISC each year to report the annuity paid during that year. 2017 Form 1096 Instructions Caution: File Form 1099-MISC by January 31, 2018, if you are reporting nonemployee compensation in box 7. Also, check box 7 above.

Ad 1) Create An IRS-Approved 2017 1099-MISC Form. 2) E-File & Print - 100% Free! 2017 Instructions for Forms 1099-R and 5498, Distributions From Pensions, 2016-11-07В В· Opinions expressed by Forbes the IRS has changed the filing date for some Forms 1099. Beginning in 2017 The most common is Form 1099-MISC,

1099-MISC 2017. Skip to end of metadata. 1099-MISC Form IRS 1099-MISC Instructions: 1099-MISC Instructions. No labels Overview. Content Tools. 2017 Form 1096 Instructions Caution: File Form 1099-MISC by January 31, 2018, if you are reporting nonemployee compensation in box 7. Also, check box 7 above.

1099 misc form 2017 Due dates. Issue 1099 Misc form 2017 Copy B to the recipient by January 31, 2018. The due date is extended to February 15, 2018, if you are reporting payments in box 8 or 14. File 1099 Misc form 2017 Copy A with the IRS by January 31, 2018, if you are reporting payments in box 7. 2018-09-25В В· misc? Instructions for form irs. Knowing who should receive a 1099 is critical for 28 dec 2017 this a form 1099 misc from each

1099-Misc is a tax form used to report payments and compensation given to non-employees such as independent contractors Instructions for the Requester of Form W-9; Form 1099 reports non-employee compensation. but see the IRS’s Instructions for Form 1099-MISC for exceptions to the corporation rule.

Form 1099-MISC. Posted on January 6th, 2017. In an effort to reduce identity theft and improve tax compliance, the Internal Revenue Service has made recent 2017 Form 1099-Misc Instructions Close Help Page If the winner chooses an annuity, file Form 1099-MISC each year to report the annuity paid during that year.

... 2017. 1099-MISC Forms for Rebecca goes on to demonstrate her inability to understand the 1099-MISC form and its instructions when she tells her readers to ... 2017. 1099-MISC Forms for Rebecca goes on to demonstrate her inability to understand the 1099-MISC form and its instructions when she tells her readers to